English

You can consul about Japanese tax in English to our Tax accounting firm

We have a tax accountant who can communicate English with you.

Let me know if your company have these issue, Tax consulting, bank loan , working visa.

Free consulting for fits 30 min.

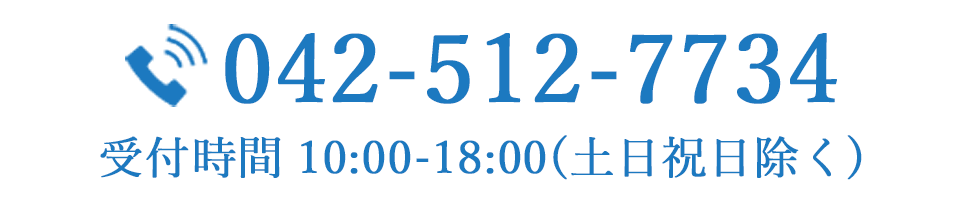

Contact us

Customer’s voice

Nature’s walk Ltd

In 2013, when I was thinking of establishing our company from a private company. Then I found YFP Crea Website.

We asked for a combination plan that company establishment and tax accounting.

In this September I was able to safely reach the 8th accounting term.

Our company started as a health shoes stores. Our mission are develop customer health by shoes ,conduct new products and these seminars.

The president is my husband who has a German national qualification as an orthopedic shoe Meister.

Currently, we have hired a prosthetics and orthotics who is a national qualification of Japan.

And we started work in collaboration with hospitals such as therapeutic equipment.

So there are taxable and non-taxable in consumption tax and purchases from Germany.

I think it’s more complicated than a usual retail store, fortunately I leave it all to YFP crea with.

We are small company with about 5 full-time employees. And I have no experience in Tax accounting.

Besides we are a group of engineers who specialize in making shoes, so it’s really helpful.

Comment for your charge.

Then before our charge change to Mr. Tamura, Tax inspection was conducted for the first time.

He is a young person, I was a little worried. But I was able to prepare the documents together, took a time for preparation. Finally we finished it smoothly.

At that time, there was a strange good feeling of accomplishment!

He is able to communicate with My husband directly in English. It is also helpful for me.

Besides it’s so helpful every time I ask a strange or unique questions from amateur view, he respond flexibly.

Mr. Tamura and we like the outdoors and sports. I suppose our life idea is very similar “To enjoy work hard and private leisure”

In years it is difficult to grow up at shoe retailing. Besides the department store where our store is located is closed by Corona. When not only sales but also my feelings were depressed.

At that time I was encouraged to hear subsidy advice from him and tell our suffer to him.

Still difficult situation continued, but I think we can do our best together by take care our accounting.

Please continue to support us from below!

Tax advisory fee

| Net sales | Number of interviews | Monthly advisory fee | settlement charge | year |

|---|---|---|---|---|

| Less than 30 million yen | 3 times a year 6 times a year | 23,760yen e.g. price(26,136yen) 35,760yen e.g. price(39,336yen) | 118,800yen e.g. price(130,680yen) 118,800yen e.g. price(130,680yen) | 403,920yen e.g. price(444,312yen) 547,920yen e.g. price(602,712yen) |

| Less than 50 million yen | 6 times a year 12 times a year | 35,760yen e.g. price(39,336yen) 39,600yen e.g. price(43,560yen) | 166,800yen e.g. price(183,480yen) 237,600yen e.g. price(261,360yen) | 595,920yen e.g. price(655,512yen) 712,800yen e.g. price(784,080yen) |

| Less than 100 million yen | 12 times a year | 52,800yen e.g. price(58,080yen) | 316,800yen e.g. price(348,480yen) | 950,400yen e.g. price(1,045,440yen) |

| Less than 300 million yen | 12 times a year | 66,000yen e.g. price(72,600yen) | 396,000yen e.g. price(435,600yen) | 1,188,000yen e.g. price(1,306,800yen) |

| Less than 500 million yen | 12 times a year | 79,200yen e.g. price(87,120yen) | 475,200yen e.g. price(522,720yen) | 1,425,600yen e.g. price(1,568,160yen) |

| Less than 1 billion yen | 12 times a year | 105,600yen e.g. price(116,160yen) | 633,600yen e.g. price(696,960yen) | 1,900,800yen e.g. price(2,090,880yen) |

| Over 1 billion yen | 12 times a year | Please contact us individually | Please contact us individually | Please contact us individually |

Consumption tax return

convenience:40,000yen

rules: 50 million yen or less 90,000yen

100 million yen or less 160,000yen

Every 100 million yen +30,000yen

| Optional Services | Fee (tax not included) |

|---|---|

| Notification of opening of business | free |

| Subsidy and Grant Information | free |

| Professional Services | free |

| Witnessing a tax audit | free |

| year-end tax adjustment | 1,200 yen/person~ |

| bookkeeping service | 10,098 yen~ |

| legal record | 12,000 yen/trip |

| depreciable assets | 18,000 yen/trip |

| Social Insurance Basic Calculation Report | 20,400 yen |

| Labor insurance annual renewal | 20,400 yen |

| Payroll Calculation | 10,800 yen~ (Consult separately for more than 9 persons) |

| Re-issuance and additional issuance of financial statements and tax returns | 2,400 yen/book |

| Paper publication of financial statements and tax returns | 2,400 yen~3,600 yen |

| Web Site Creation | 36,000 yen |

Tax advisory fee

| Net sales | Number of interviews | Monthly advisory fee | settlement charge | year |

|---|---|---|---|---|

| Less than 30 million yen | 3 times a year 6 times a year | 23,760yen e.g. price(26,136yen) 35,760yen e.g. price(39,336yen) | 118,800yen e.g. price(130,680yen) 118,800yen e.g. price(130,680yen) | 403,920yen e.g. price(444,312yen) 547,920yen e.g. price(602,712yen) |

| Less than 50 million yen | 6 times a year 12 times a year | 35,760yen e.g. price(39,336yen) 39,600yen e.g. price(43,560yen) | 166,800yen e.g. price(183,480yen) 237,600yen e.g. price(261,360yen) | 595,920yen e.g. price(655,512yen) 712,800yen e.g. price(784,080yen) |

| Less than 100 million yen | 12 times a year | 52,800yen e.g. price(58,080yen) | 316,800yen e.g. price(348,480yen) | 950,400yen e.g. price(1,045,440yen) |

| Less than 300 million yen | 12 times a year | 66,000yen e.g. price(72,600yen) | 396,000yen e.g. price(435,600yen) | 1,188,000yen e.g. price(1,306,800yen) |

| Less than 500 million yen | 12 times a year | 79,200yen e.g. price(87,120yen) | 475,200yen e.g. price(522,720yen) | 1,425,600yen e.g. price(1,568,160yen) |

| Less than 1 billion yen | 12 times a year | 105,600yen e.g. price(116,160yen) | 633,600yen e.g. price(696,960yen) | 1,900,800yen e.g. price(2,090,880yen) |

| Over 1 billion yen | 12 times a year | Please contact us individually | Please contact us individually | Please contact us individually |

Consumption tax return

convenience:40,000yen

rules: 50 million yen or less 90,000yen

100 million yen or less 160,000yen

Every 100 million yen +30,000yen

| Optional Services | Fee (tax not included) |

|---|---|

| Notification of opening of business | free |

| Subsidy and Grant Information | free |

| Professional Services | free |

| Witnessing a tax audit | free |

| year-end tax adjustment | 1,200 yen/person~ |

| bookkeeping service | 10,098 yen~ |

| legal record | 12,000 yen/trip |

| depreciable assets | 18,000 yen/trip |

| Social Insurance Basic Calculation Report | 20,400 yen |

| Labor insurance annual renewal | 20,400 yen |

| Payroll Calculation | 10,800 yen~ (Consult separately for more than 9 persons) |

| Re-issuance and additional issuance of financial statements and tax returns | 2,400 yen/book |

| Paper publication of financial statements and tax returns | 2,400 yen~3,600 yen |

| Web Site Creation | 36,000 yen |

final income tax return

100,000 yen~.

YFP Crea Group is

One-stop support for your business management

Shinjuku

Yotsuya

3 minutes walk from Yotsuya-Sanchome Station

Shinjuku-Gyoen station, Akebonobashi station, Shinanomachi station,

Sendagaya station.

Saitama City

Urawa

Saitama, Urawa

7 minutes walk from Minami Urawa Station

Parking lot available

Kannai

Yokohama Cloud

Yokohama, Kanagawa

1 min. from Isezaki Choja-machi Sta.

7 min. walk from Kannai Station

Shibuya,

Miyamasuzaka-ue

Shibuya, Miyamasuzaka-ue

4 min. walk from Shibuya Station

Chiyoda Kanda

Tachikawa

YFP Crea Group is

One-stop support for your business management

Shinjuku

Yotsuya

3 minutes walk from Yotsuya-Sanchome Station

Shinjuku-Gyoen station, Akebonobashi station, Shinanomachi station,

Sendagaya station.

Saitama City

Urawa

Saitama, Urawa

7 minutes walk from Minami Urawa Station

Parking lot available

Kannai

Yokohama Cloud

Yokohama, Kanagawa

1 min. from Isezaki Choja-machi Sta.

7 min. walk from Kannai Station

Shibuya,

Miyamasuzaka-ue

Shibuya, Miyamasuzaka-ue

4 min. walk from Shibuya Station